HealthyCapital app for iPhone and iPad

Developer: HealthyCapital, LLC

First release : 24 Jun 2018

App size: 50.66 Mb

Be Well. Be Wealthy.

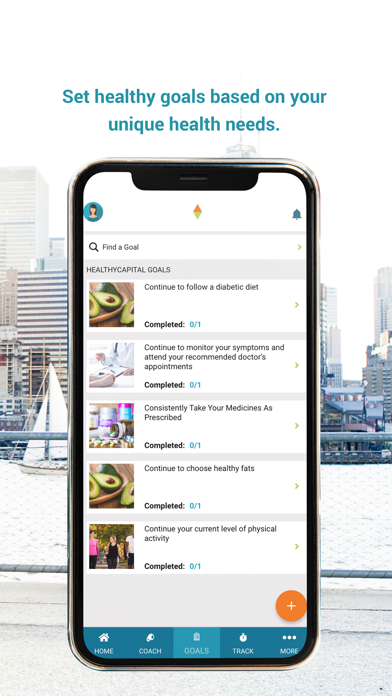

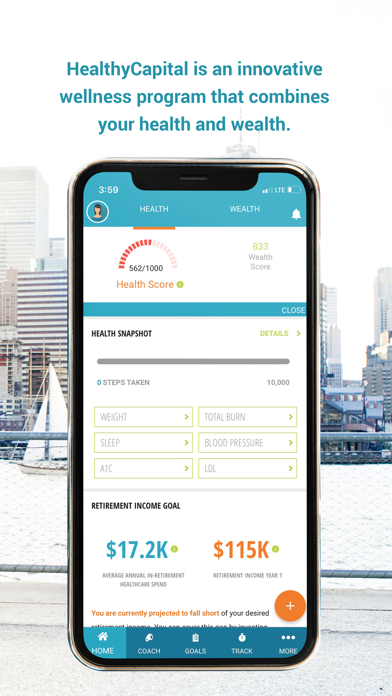

Did you know you could put money in your pocket just by doing simple things –such as gardening a few times a week or remembering to take your medications every day? We can help you find that money and put it toward your savings – making you healthier and wealthier as the program progresses. HealthyCapital’s revolutionary behavior modification platform provides quantitative evidence on how better health leads to more wealth – today, and in the future. The application utilizes actuarial data to illustrate how “losing that pound” or “taking that walk” translates into real savings, which can be dedicated to any current or future expenses.

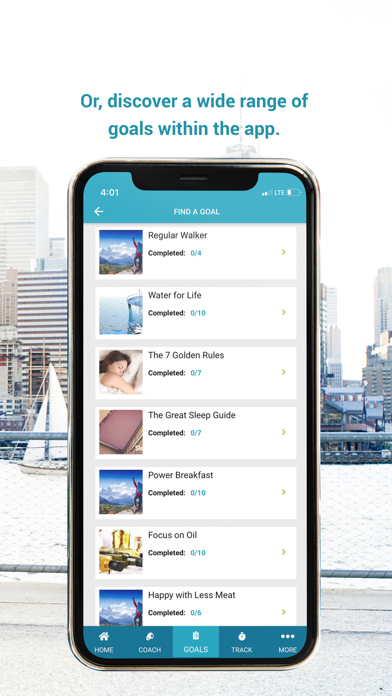

HealthyCapital motivates you to improve your health by showing you the monetary value of simple behavior change. For ongoing motivation, your health and wealth scores improve through your level of participation – such as chatting with coaches specialized in health, nutrition, finances and more, meeting goals, participating in challenges, and more. We take a holistic approach as improved behaviors not only affect health, but wealth, too.

The Health and Wealth Scores: The health and wealth calculations, which range from 1 to 1,000, are real-time indicators that break down physical, financial, and emotional health.

The Three Pillars of Wealth

Savings

Contributions

Gap

The Three Pillars of Health

Lifestyle

Mind

Body

HealthyCapital tracks 115 indoor and outdoor activities. Your workouts are tracked automatically (using HealthKit and other device connections), with the option to add any others manually. Create and join friendly competitions with friends, coworkers, and other HealthyCapital users!

Your journey to better health and more wealth will culminate with a long and comfortable retirement, which can be attained by dedicating the new savings toward investments. Use the Financial Dashboard to allocate some (or all) of those savings into an account, such as a 401(k) or an HSA, and watch your money grow. Advisors are standing by ready to help!